Estimated reading time

Transforming Credit Unions for the Digital Age

In today’s rapidly evolving financial landscape, credit unions face a significant challenge: maintaining their personalized, member-first approach while adopting the technological advancements necessary to meet modern expectations. Larger banks and fintech companies are leveraging cutting-edge technologies to offer instant services, leaving many credit unions struggling to keep up without compromising their core values.

Automation as a Service (AaaS) presents a solution to this dilemma, enabling credit unions to modernize their operations, enhance member experiences, and remain competitive—all without massive technology investments. By leveraging automation solutions, credit unions can streamline processes, offer personalized services, and focus more on building relationships with their members.

The Credit Union Challenge

Imagine this – Your credit union has a healthy membership base, solid digital banking platforms, and dedicated staff. Yet, you’re noticing a concerning trend: when members apply for loans, they’re increasingly choosing fintech lenders or big banks instead. Not because of rates – yours are competitive or even less – but because these competitors offer instant decisions and digital processes while your loan officers spend hours gathering data from multiple systems to make the same decisions.

“We were losing deals not on relationships or rates, but on speed, as one credit union CEO puts it. “Our members love our service, but in today’s world, making them wait three days for a loan decision when they can get one in minutes elsewhere just isn’t competitive.”

This scenario plays out across multiple services – from member onboarding to financial advisory services. Credit unions have the data, they have the expertise, but they need a way to automate and connect these capabilities without massive technology investments.

The Power of Automation as a Service

Today’s credit union members expect seamless, digital-first experiences alongside the personal service they’ve always valued. This is where Automation as a Service becomes a game-changer. Let’s explore how modern automation solutions are revolutionizing credit union operations.

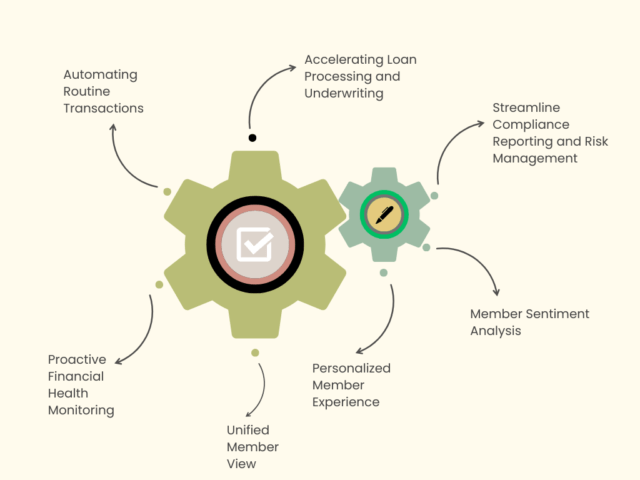

Automation + Analytics – 7 Ways How Transformation is Possible

-

- Streamlining Compliance Reporting and Risk Management

Regulatory compliance is critical but often resource intensive. Automation solutions can extract necessary data, evaluate it against regulatory standards, and generate compliance reports with minimal manual intervention. - Creating a Unified Member View through Data Management

Disparate data systems can create silos that obscure a complete understanding of member needs. Automation facilitates the integration and cleansing of data from various sources to create a unified, accurate profile for each member. - Automating Routine Transactions to Boost Efficiency

Routine administrative tasks can consume valuable staff time. Automation solutions for processes like account applications, maintenance requests, and information updates can greatly improve operational efficiency. - Accelerating Loan Processing and Underwriting

Speed is crucial in loan approvals. By automating the underwriting process with AI-driven models, credit unions can assess creditworthiness swiftly using a broad set of data points beyond traditional credit scores. - Proactive Financial Health Monitoring with Predictive Analytics

Supporting members’ financial well-being fosters trust and loyalty. Automation enables the development of predictive models that assess financial health trends, allowing credit unions to offer timely financial advice or tailored products. - Delivering Personalized Member Experiences with AI and Analytics

Modern members expect services tailored to their unique needs. By implementing AI-driven analytics, credit unions can offer personalized product recommendations based on individual member behaviors and preferences. - Analyzing Member Sentiment for Improved Services

Understanding member sentiment is key to delivering exceptional service. Using Natural Language Processing (NLP), automation helps credit unions analyze feedback from surveys, emails, and social media.

- Streamlining Compliance Reporting and Risk Management

Bridging Tradition with Innovation

Automation doesn’t mean losing the personal touch but quite the opposite. By automating routine processes and leveraging data intelligently, credit unions can enhance the personalized service that members value. Staff can spend more time engaging with members and less time on administrative tasks.

For example, automating loan processing not only speeds up approvals but also allows loan officers to focus on advising members on the best financial options. Similarly, predictive analytics can help identify members who may benefit from financial planning services, enabling proactive outreach.

Take a giant leap towards exceptional customer experiences—download our PDF Here to see how automation and analytics are transforming the future of credit unions.

“As automation transforms how credit unions operate, the real winners are the members themselves. They get faster service, more personalized attention, and a financial partner that combines the best of both worlds: cutting-edge capability with community-focused care.”

Struggling with legacy systems? Our Team can help. Contact us today.