Estimated reading time

Data Analytics – High Priority Ticket for Credit Unions

Credit unions are sitting on a goldmine of member data – but are they using it to its full potential? In today’s digital-first world, where members expect Netflix-level personalization from every service, data analytics isn’t just nice to have – it’s essential for survival.

Why should credit unions prioritize data analytics right now? Because rising interest rates are disrupting the lending landscape, digital banking has become essential as members demand more convenience, fintech competitors are getting more aggressive and sophisticated, member expectations have soared post-COVID, and traditional growth strategies are no longer effective.

Game Changing Results

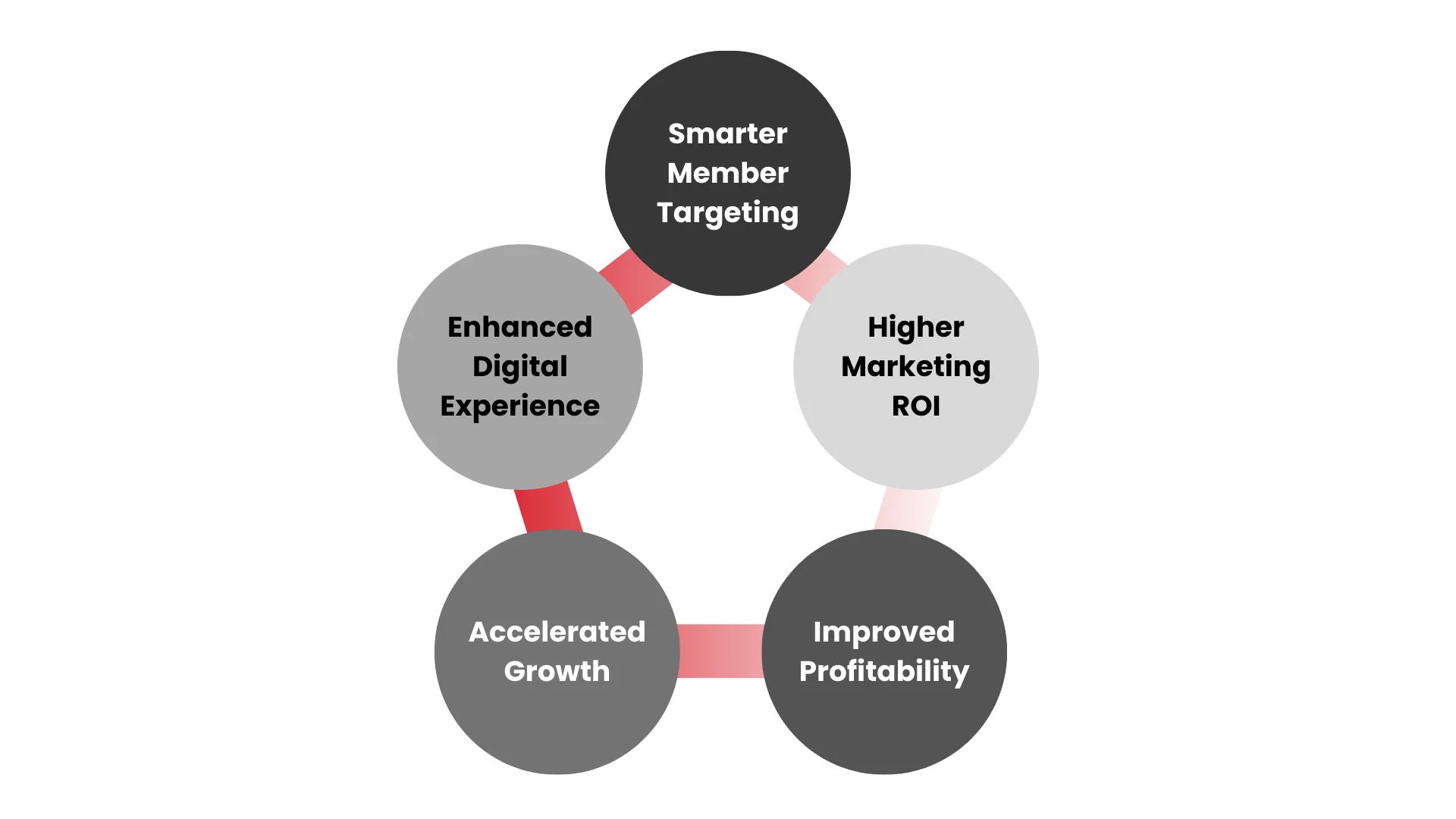

The good news? Credit unions that adopt data analytics are witnessing these game-changing results:

Smarter Member Targeting – Move beyond guessing and gain the ability to pinpoint exactly which financial products will meet your members’ needs.

Better Digital Experiences – Create digital services and applications that engage members and keep them coming back.

Higher Marketing ROI – Reach the right members with the right offers at the right time, maximizing marketing impact.

Faster Growth – Stay ahead of your competitors by identifying emerging trends and opportunities early.

Improved Profitability – Leverage data-driven decisions to drive higher profits and more efficient operations.

According to the Chief Data Officer of a leading Credit Union, “Data analytics has become the core driver of growth and member satisfaction for forward-thinking credit unions. By turning member insights into action, we’re not just staying competitive – we’re elevating the entire credit union experience.”

A Strategic Data Analytics Roadmap for Credit Unions

As the financial landscape continues to evolve, credit unions are faced with a pivotal question: how can one unlock new levels of growth and efficiency with data analytics?

The path lies in a carefully crafted strategy that addresses these 6 essential areas:

- Streamline Operations – What repetitive, manual tasks are draining your team’s productivity that could be automated through a data analytics solution?

- Elevate Employees – How can you empower your staff to focus on higher-value, strategic work instead of tedious reporting?

- Optimize Costs – What vendor contracts or unnecessary expenses could be reduced or eliminated by centralizing your data?

- Improve Data Quality – Have you quantified the costs associated with inaccurate or hard-to-access data?

- Accelerate Projects – How have data challenges previously delayed or inflated the budget of key initiatives?

- Enhance Decision Making – What insights could advance analytics unlock to drive smarter, more profitable decisions?

By addressing these crucial questions, you’ll uncover a clear roadmap to build a data-driven credit union. The right analytics strategy can streamline operations, elevate your workforce, optimize costs, and deliver the high-impact insights needed to stay ahead of the competition.

Examples of how analytics helped Credit Unions

Let’s look at how a few credit unions have successfully used data analytics to drive remarkable growth and improve their member services

-

- A Michigan-based Credit Union secured a few million dollars in new home equity loans.

Success Factor: Smart targeting through in-depth member data analysis.

- A Michigan-based Credit Union secured a few million dollars in new home equity loans.

-

- A Hawaiian Credit Union increased deposits by 40%.

Key Strategy: Data-driven approach to identifying high-potential depositors.

- A Hawaiian Credit Union increased deposits by 40%.

-

- A Regional Credit Union achieved a ~67% growth in its credit card portfolio.

Winning Approach: Engaging members based on their spending behaviors and patterns.

- A Regional Credit Union achieved a ~67% growth in its credit card portfolio.

-

- A Midwestern Credit Union Secured a few million dollars in new loans and helped almost a quarter of its members increase credit scores and upgrade their credit tiers.

Method: Data-backed outreach to target and engage the right members effectively.

- A Midwestern Credit Union Secured a few million dollars in new loans and helped almost a quarter of its members increase credit scores and upgrade their credit tiers.

Transform Your Credit Union’s Growth with Data Analytics Today!

In the modern-day financial landscape, credit unions are either forced to adapt or left behind. Most innovative & visionary institutions are leveraging data analytics to drive transformative growth – unlocking greater efficiency, deeper member relationships, and game-changing profitability.

When credit unions expedite focused efforts in automating their key business processes and leverage analytics to gather insights, they transform themselves into Next-Gen credit unions that offer superior member experiences.

Explore how automation can streamline repetitive tasks and enhance productivity for your team. Read our blog: Automation for Credit Unions.

Don’t let your credit union fall behind—unlock the full potential of your data with our expertise. Contact Zura Labs today and embark on a transformative journey to drive growth and elevate member experiences.